GST

Complaince

GSTR-1 (Sales)

# The complete GSTR1 (Outward Return) can be exported to Excel from the software,

# The GSTR1 Excel file can be directly uploaded in its current format on the GST Portal,

# B2B, B2C, B2Cs, Exemp, Hsn, cdnr, cdnur, docs,

# All elements of GSTR1 are incorporated,

# Several outlets of a single company included in one GSTR1,

# Obtain the GSTR1 with a single click and send it to the Accounts team.

GST Dashboard

# Entire GST Related Figures in a single Dashboard,

# SGST+CGST, IGST in all formats,

# Purchase, Purchase Return, Sale, Sale Return, DebitNote, CreditNotes etc..,

# Consolidated Report for All Stores or Individual Store,

# Any data Can be Export to excel,

# Tally Friendly,

# HSN code wise Split Values.

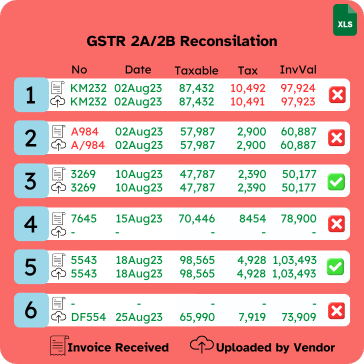

GSTR 2A/2B Reconciliation

# GST Reconciliation for 2A or 2B,

# Retrieve the GSTR2B JSON file from the GST Portal and upload it to the software,

# Compare all elements and identify any mismatches in the values,

# Not in Purchase, Not uploaded in GSTR2B with a Single Click,

# Saves lot of time for the Accounts team during the reconciliation process,

# Export to Excel and perform the required actions.

GSTR-3B (Purchase)

# GSTR-3B purchase monthly return dashboard,

# All components of GSTR-3B included,

# Outward Taxable supplies in all formats (3.1),

# Purchase according to placeofsupply (3.2),

# Import of Goods, Import of Services (Elegible ITC),

# Non GST Inward,

# Export to excel.

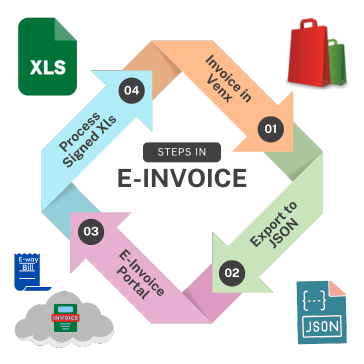

E-Invoice

# Initiate B2B Sale Transaction in POS,

# Choose the list of invoices and export them to an offline JSON file,

# Submit the JSON file to the GST E-Invoice Portal. This action will produce E-Invoices and provide a signed Excel file.,

# Process signed Excel in Software,

# An e-waybill can also be generated simultaneously,

# Obtain IRN number, AckNo, SignedQr, EwayBillNo from Processed Invoices.

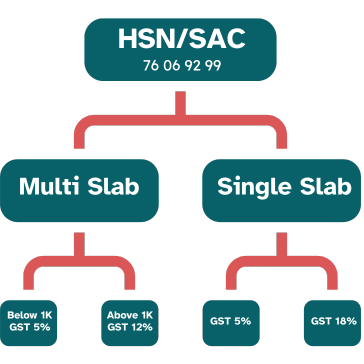

HSN Code Setup

# 8 Digit HSN code for every product,

# Activate the necessary pre-HSN codes and allocate them to the respective products,

# MultiSlabs has the capability to associate Hsncode with a specified price range,

# Allocate the GST tax rate to the HSN code,

# Add Cess if neccesery,

# Hsncode wise GST Reports, Eway Bills, EInvoices,

# HSN code wise Split Values.

Support

Frequently Asked Questions

GST, or Goods and Services Tax, is a comprehensive indirect tax levied on the manufacture, sale, and consumption of goods and services across India. It is a single tax that has replaced multiple indirect taxes like VAT, service tax, excise duty, etc.

GST is divided into four types:

CGST (Central Goods and Services Tax): Levied by the Central Government on intra-state sales.

SGST (State Goods and Services Tax): Levied by the State Government on intra-state sales.

IGST (Integrated Goods and Services Tax): Levied by the Central Government on inter-state sales.

GSTIN stands for Goods and Services Tax Identification Number. It is a unique 15-digit number assigned to every registered business under GST. The GSTIN is used to monitor tax payments and filings.

GST is calculated by applying the applicable GST rate (e.g., 5%, 12%, 18%, 28%) to the value of the supply of goods or services.

The formula is: GST Amount = (Value of Supply) x (Applicable GST Rate)

Venxmart offers a range of reports and export options for GST, facilitating a straightforward filing process. It proves to be more user-friendly than initially anticipated regarding GST compliance.